What Strategies Can An Insurance Coverage Agent Employ To Help You Save Cash?

Uploaded By-Andrews Scott Have you ever wondered how an insurance policy representative could assist you conserve cash? Well, the fact is, their competence exceeds simply finding you a plan. By delving into the intricacies of insurance policy protection and tapping into numerous price cuts, agents have the power to dramatically affect your profits. However that's simply the tip of the iceberg. Remain tuned to get https://milawyersweekly.com/news/2023/07/10/no-special-relationship-between-policyholder-insurance-agent/ about the certain methods an insurance coverage agent can place more money back in your pocket.

Benefits of Using a Representative

When it comes to browsing the complex globe of insurance policy, utilizing the knowledge of an insurance policy agent can be exceptionally beneficial. An agent can aid you recognize the intricacies of different insurance plan, ensuring you pick the ideal insurance coverage for your certain demands. As opposed to investing hours looking into and contrasting policies on your own, an agent can streamline the process by offering individualized recommendations based on your private conditions. Moreover, insurance coverage representatives often have access to a variety of insurance coverage companies, allowing them to assist you locate the very best insurance coverage at affordable costs. They can bargain in your place and potentially protected discounts that you may not have had the ability to access by yourself. In addition, in case of a case, agents can assist you through the procedure, answering any type of concerns and advocating for your best interests.

Making The Most Of Policy Discount Rates

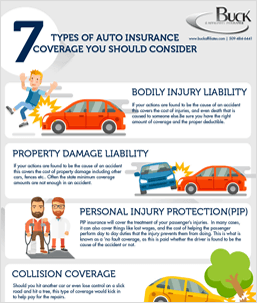

To ensure you're obtaining the most out of your insurance policy, making best use of offered discount rates is crucial. https://simple.wikipedia.org/wiki/Life_insurance#cite_note-3 can aid you recognize and take advantage of different discounts that you may get approved for. For example, bundling your home and vehicle insurance coverage with the very same service provider frequently results in a substantial price cut. In addition, having an excellent driving record, mounting safety features in your house or automobile, and even being a member of particular companies can make you eligible for more price cuts. Make sure to notify your insurance coverage representative about any life changes or updates in your circumstances, as these may open brand-new discount rate opportunities.

Staying Clear Of Expensive Coverage Mistakes

Avoid falling under costly insurance coverage errors by completely recognizing your insurance policy information. One common error is taking too lightly the value of your ownerships when setting coverage limits. Make certain that your plan precisely shows the substitute price of your possessions to stay clear of being underinsured in the event of a claim. Additionally, falling short to upgrade your policy regularly can lead to spaces in coverage. Life modifications such as getting a brand-new automobile or renovating your home might call for adjustments to your insurance to sufficiently secure your assets. One more costly blunder is neglecting extra coverage options that could offer important defense. For example, umbrella insurance can offer expanded liability protection past your standard plan limits, protecting your possessions in high-risk scenarios. Lastly, not understanding your plan exemptions can lead to unexpected out-of-pocket costs. Take the time to examine and clarify any kind of exemptions with your insurance agent to prevent being caught off guard by exposed losses. By being positive and informed, you can avoid costly insurance coverage blunders and guarantee your insurance policy fulfills your needs. Conclusion Finally, dealing with an insurance policy agent can be a wise economic action. They can assist you understand plans, make best use of discount rates, and avoid pricey blunders, eventually saving you money. By leveraging their competence and sector understanding, you can secure the very best coverage at affordable rates. So, consider seeking advice from an agent to guarantee you are obtaining the most worth out of your insurance plan.